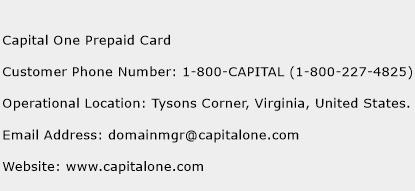

If you do miss a payment, it's important that you catch it early. (Photo by Tashdique Mehtaj Ahmed/Getty Images) Catching missed payments early Sometimes a simple phone call or letter is all it takes to get a late payment removed from your credit score. Keep in mind that you'll want to make sure your late bill is paid before reaching out. Capital OneĬapital One doesn't have a policy against goodwill adjustments, which means you can call or mail in to request a late payment to be removed from your account. Like Amex, there are plenty of success story data points available on sites like myFICO where customers were able to reach out and get a late payment removed from their report. CitiĬiti is another issuer that allows requests for goodwill adjustments.

Many online forums have reported success stories in the past of customers being able to request a goodwill adjustment. Unlike some of the others on this list, American Express doesn't list a specific policy on its website against goodwill adjustments. In Chase's frequently asked questions about credit reporting, they state that they do not make goodwill or courtesy credit report adjustments. Bank of Americaīank of America's terms clearly state that they do not honor goodwill adjustment requests. Some issuers even have outright policies against making any adjustments after your late payment has been reported to the credit bureaus. Keep in mind that issuers are not required to make adjustments. (Photo by cnythzl/Getty Images) Issuers with goodwill adjustment policies Your specific request to have the information removed from your credit reports.Reasoning for why you missed your payment due date.When you call or write in, make sure to include the following: You can also reach out via email, but emails can easily get lost in the shuffle. Just keep in mind that the first person you talk to on the phone may not be able to help you'll need to politely request to escalate the issuer to a manager or different department that can handle the request. You can also call the number on the back of your credit card to talk to a customer service representative to request the late payment be removed. Of course, a goodwill letter doesn't necessarily have to be a physical letter.

These requests are not meant to dispute errors on your credit report (which should be taken up with the three credit bureaus) - rather they are an apology to your credit issuer for missing the payment and a goodwill statement that you will pay your bills on time moving forward. Negative marks against your credit report can stick around for up to seven years, but these simple requests can help keep your report spotless and your credit score healthy. What is a goodwill letterĪ goodwill letter is a request made to your creditor to remove the report of the late payment from your credit report. Want more credit card news and advice? Sign up for the TPG newsletter. The good news is that there is a way to potentially save your credit score when slipups happen and you miss your payment due date on accident - goodwill letters. In fact, payment history is the largest factor considered for your FICO score (which is what most lenders use to determine creditworthiness). Late payments can come with penalty APRs and late fees that can impact your budget, but a late payment can also potentially impact your credit score. While it's important to pay credit card bills on time (and in full, whenever possible), it's understandable that sometimes things happen - especially during the crazy times we currently live in.

0 kommentar(er)

0 kommentar(er)